It was only recently that I started to get interested in savings and finance.

I’m thirty, but I actually didn’t put a penny into savings or retirement accounts until I turned 29. This is mainly because I’ve been paying back my crazy over $100,000 undergrad loan from NYU (which I lament thoroughly about here), but also because of financial obliviousness.

Neither the college that put me in debt nor the free public high school before that taught me how much I should have in savings, or when and how I should open a retirement account or what I should do if I have a kid and need to save for THEIR college. In short, I learned nothing about money other than that I would never have enough of it.

My lifetime of money ignorance was forever changed by the discovery of podcasts. I was a very late adopter to the podcast wave, and never listened to them until I turned 29. One of my least techie friends had actually told me about a great podcast app that she loves (after she finally traded her flipphone for a smartphone), and I downloaded it on the spot.

Suze Orman‘s and Dave Ramsey‘s podcasts popped up on the “Popular Podcast” screen, and I vaguely remembered a coworker telling me about how she only carried cash around because of following Dave Ramsey’s “Envelope System” for budgeting. I started listening to both financial gurus, and was immediately hooked. There’s a ton of wonderful and easy to understand information in their finance podcasts (they have books too, but I love the podcasts most of all). Their advice is for both money novices and money experts and they have distinctly different styles (each is fun). Both of them answer questions from callers, and I find that to be a great way to learn about solving money issues.

Below, I’m going to go over some of the most basic savings advice I’ve learned from Dave and Suze. This list leans a bit closer towards Suze Orman’s advice because I tend to follow her more, but she and Dave Ramsey follow similar money habits. I’ll delve even more into each item in the future, but here are the basics:

1. You should be working towards an 8 month emergency fund

This seemed like a ridiculously high amount to me at first, but it makes sense. After the recession, I knew a few people who were laid off and barely found another job within a year. You need to prepare for all types of emergency scenarios.

Suze Orman says that you should only spend as much as 10% of the amount you have in savings on things you WANT (like a trip to Hawaii). This is opposed to things you need (like medicine), where you may be forced to spend more. If you’re spending more than 10% of your savings on something, you cannot afford it! Thinking about spending in this way really shifts your perspective on how much money you can afford to spend.

2. Open up or make sure you’re funding your retirement account(s), and look into the MAGICAL ROTH IRAs

If you’re working at a job where your company matches your retirement contributions in a 401(k) up to a certain point, you MUST take the match. It doesn’t matter if you can barely pay your bills- contribute to the retirement fund up to the match and rake in FREE MONEY!

Then, once you’ve met the match (or if you’re self-employed like me and can’t contribute towards a 401(k))- look into opening an IRA, especially a Roth IRA. The major difference between a Roth IRA and a regular IRA is that you put after-tax dollars into a Roth IRA and get no special tax benefits from one. With a regular IRA, you deduct your contributions from your taxable income right NOW. Then you have to pay taxes on the money when you withdraw it during retirement. At first, this seems to make IRAs sound more attractive. However, Roth IRAs are completely tax-free when you take all the money you’ve earned on them out after retirement (all that interest money will be tax-free)! Plus, you can take money out of a Roth IRA whenever you want WITHOUT PENALTY FEES, so the Roth can double as another emergency fund!

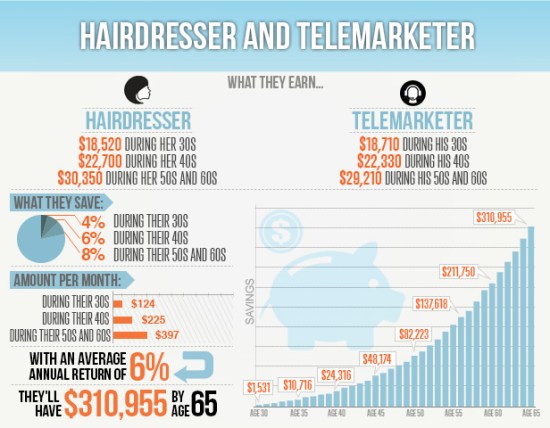

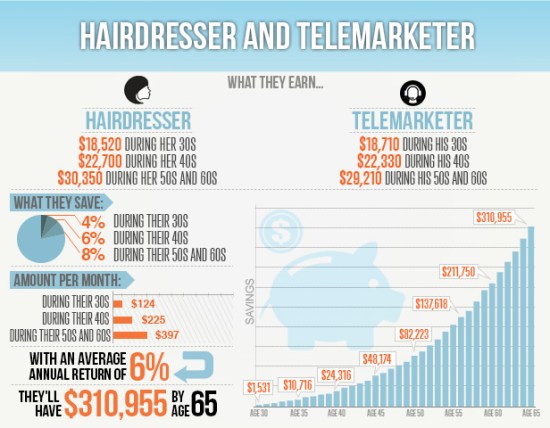

See below for how someone who works as a telemarketer or hairdresser and makes low to average salary (taken from the Bureau of Labor Statistics) will still make crazy money with a Roth IRA:

ROTH IRA’s give back mucho earnings even for low contributions, especially when you START EARLY

3. Pay off your debt as fast as you can

This is something I already knew half of. I knew the ‘pay off your debt’ part… but once I realized the benefits of really “getting angry” (a Dave Ramsey term) at my debt and putting all my efforts into killing off my student loans, I really started to make some progress. If you have credit card debt, concentrate on paying off whatever the highest interest card is first (after, of course, paying minimums on all other debt).

If you have debt (except for mortgage debt, which is different), DON’T JUST PAY THE MINIMUM and try not to stop paying! Interest will put you into a hole you don’t want to be in, so don’t let it gather. I had one student loan that was 14,000 dollars originally. I got it down to 11,000 over a period of several years by just paying the minimum. Then I put the loan into deferment (where you can legally stop paying for a time but interest still accrues) for just one year, and the loan went BACK UP to 14,000! Interest is a dangerous game when it comes to debt. So make paying off your debt a huge priority and don’t just let it sit around.

4. If you have a child, consider opening up a 529 Plan for their college savings

I don’t have a child yet, but I know how hard it’s been to pay off my own college tuition. I sure wouldn’t want anyone else to struggle with student loans when there are better solutions. The 529 Plan is a way to use interest to your advantage by starting a special savings account for your child’s college education. Your money will grow into exponentially more than you contributed originally. It’s best to start very early with this- right when your child is born. See below for how much 529 contributions can grow when starting early.

529 plan growth based o contribution and period of TIME

5. It’s never too late!!

Please don’t feel down if you’re behind on these steps. If you have only some or none of these things started, it’s still okay! Start now! You have plenty of time for your money to grow. Even if you’re reading this in your 60s, its not too late! Every step helps, and it’s amazing what you can do if you just make your finances a priority!

Please feel free to comment with any questions or savings/debt anecdotes. I’m still learning about all of this myself, so I’d love to hear from you. I’ve made tons of progress in a year just by incorporating these steps (except the last one) into my life, so I hope this is helpful!