With Health Insurance possibly overhauling entirely in America in the coming years, and with the rocky fate of the ACA always up in the air, health insurance has been on my mind lately.

As a completely self-employed individual, I have a health care plan from the ACA marketplace. Before this, I had no health insurance at all since getting off of my parents’ plan in my twenties. Nowadays, because I try to be as financially responsible as I can, I really don’t like the idea of not having health insurance. Besides the tax consequences where you must pay a fine if you don’t have health insurance come tax time, I don’t like to take gambles with large amounts of money. So I don’t like the idea of suddenly being hit with huge medical bills that could’ve largely been covered by insurance, if I had it.

Even though I’ve had people tell me things such as I don’t need health insurance because I’m a healthy vegan, because I’m paleo, because I do crossfit, because I’m a marathon runner, because I have a connection with the universe, etc, none of those things will help you if you god forbid get hit by a car (okay, maybe your connection with the universe will… that’s hard to beat). But mainly, if something happens to you that can’t be completely controlled by nutrition or exercise, you want health insurance as a just-in-case.

On a couple of finance podcasts, including Paula Pant’s Afford Anything, the HSA (Health Saving’s Account) has come up a few times and has peaked my interest. Basically, an HSA is a savings account where you can contribute up to a tax deductible $3,400 ($6,750 for families) that can be used for medical expenses. Because the money you contribute to an HSA is tax deductible, whatever you contribute to it is a tax write-off, which is a nice benefit to this type of account.

So basically, if you have an HSA, the money accumulating inside of it is supposed to be used for health-related expenses (except for health insurance payments- it primarily cannot be used for that, which is disappointing). There’s good news and bad news here. If you use the money for healthcare related expenses, it will never be taxed, so that’s great! If you use the money for anything other than health related expenses before the age of 65, you’ll owe a 20 percent penalty. Womp womp. So anything you place inside your HSA should be money that you won’t need to to spend unless you’re in a healthcare emergency- which only makes it a good retirement vehicle if you know you won’t touch it for anything besides healthcare and retirement.

Even with these drawbacks, the HSA is an interesting and possibly very helpful supplemental savings vehicle for retirement. I use the word supplemental because you can only stash $3400 in it a year, so it would go along well with your normal 401K (where you can stash a max of $18,000 a year) and/or IRA/Roth IRA (where you can stash a max of $5500 a year). Since the money can only be used for healthcare BEFORE AGE 65, that leaves the money up for grabs AFTER 65. Here’s how a lot of people who can afford it are using the HSA as a backdoor way to have extra money for retirement:

- When you have an HSA, you must get a healthcare plan that goes with it. These are specific, high deductible plans, where the deductible (what you’d pay out of pocket) is at least $1,300 with a max of $6,550 (after which you’d be covered). This means that if you’re considering an HSA, you may have to change health insurance plans, because only certain plans are compatible.

- Once you have an HSA and compatible insurance plan, you can use the HSA as a supplemental retirement strategy by paying your healthcare costs out of pocket, and saving the receipts. To use this money for retirement, you don’t want to have to actually take the money out of your HSA until you’re 65 (or even later), so you can let it all grow tax-deferred without diminishing it.

- After you’re 65, you can take the money out with no penalty, but you don’t HAVE to start taking money out at a certain age (the way you have to with many traditional retirement accounts). You can take the money out whenever you want, as it continues to grow interest, which is a nice benefit.

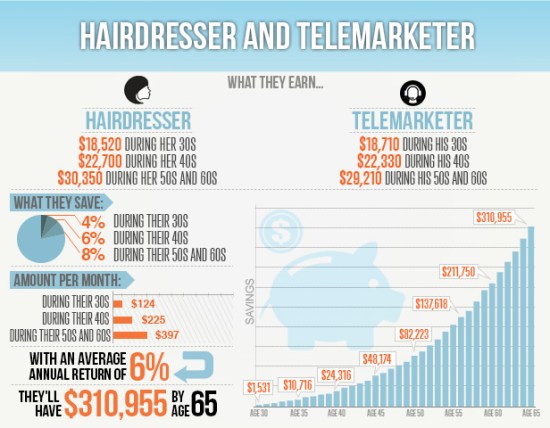

- The money in your HSA isn’t just sitting around, the way it would be in a traditional savings account (giving you 0.025% to 1.20% interest). The money is actually invested in a possible variety of mutual funds and investments (exactly which investments these are depends on your HSA and what’s available to you). Therefore, as a retirement savings supplement, your HSA is a nice investment vehicle.

- The reason you might hear HSAs referred to as having triple tax benefits is because 1. All contributions to HSAs are pre-tax (as I talked about above, anything you contribute, you can write off on your tax bill), 2. The HSA account value grows tax-deferred (you don’t pay taxes on the interest you’ve made until you withdraw the money and you never pay taxes on any of it if you withdraw the money for medical care), and 3.“Qualified” distributions from your HSA—those used for medical expenses—can be withdrawn free of income taxes. So that’s three tax benefits right there.

The HSA is a fairly new type of healthcare plan to have, so we’ll see how it grows and changes. As of now, the drawbacks are:

- You don’t necessarily get the same types of investment options as you get in a typical 401K or IRA. There may be more fees associated with these investments- which can cut into the tax benefits you’re gaining.

- You must have high-deductible insurance. This means that in order to use the HSA as an effective retirement vehicle, you have to pay most of your medical bills out of pocket (not using the HSA money, because then you wouldn’t have it for retirement) until you reach the deductible limits.

- If you don’t have extra money to sock away for retirement, and/or you’re not great with saving money that can be used for health care costs, an HSA probably isn’t for you.

The HSA is an interesting possibility for extra retirement money, and a lot of financial advisors are excited about it. As of now, I don’t have one because I’m still filling up my Roth IRA, but it’s on my mind as a possibility for the future.

If you want to read more about pros and cons of HSAs, here are some articles I found helpful:

From Nerdwallet (always a great source): What is an HSA?

From The Balance (these guys LOVE the HSA): Why You Might Want to Fund an HSA Over an IRA

From Forbes (triple tax benefit explanation): Why every 50 year old should be maximizing an HSA

From Marketwatch (health dose of cynicism balanced with benefits): HSA Accounts- The Good News and Bad News

Hope this is helpful! As always, let me know if you have any questions or comments in the comment section below.