As long as you’re earning income, you can open up a Roth IRA. I’ve written a lot about why Roth IRA’s are amazing here and here and here and also here, but in a nutshell, they are magical investment vehicles that allow your earnings to grow tax free FOREVER.

So if you invest $100 in your Roth IRA and that $100 earns $15 interest this year, that $15 will NEVER be taxed. EVER. Even when you take it out of your Roth IRA after you retire (as long as that is after age 59 and a half), and spend it, no tax monster will come to get you.

So imagine that you invest $100,000 over the course of a couple of years and it earns $15,000 of interest in that same couple of years. That $15,000 will also never be taxed. EVER. Do you see how this can add up? In a standard IRA (not a Roth), you will be be taxed on ALL of your interest the second you remove any of it from your account. That’s a lot of tax.

So, if you haven’t opened up a Roth IRA yet, here’s exactly how to open one up at Vanguard RIGHT THIS VERY MOMENT. It should take you less than 20 minutes to do this, and if you get lost you can call Vanguard and they’ll walk you through it. They’re amazing on the phone! Vanguard is my favorite financial establishment for Roth IRAs, as they have the lowest fees (almost none), and fees can really add up over the years so it’s best to stop them in their tracks early. Vanguard has been great for me so far, and I think you’ll love them- they’re extremely helpful, with an easy to use website, low to no fee funds, and they have amazing customer service. So follow the steps below to open your account. (Disclaimer: I have not been sponsored by Vanguard, or by anyone, to write this. I just love Vanguard’s services!)

Also, you will need at least $1000 to open up a Roth IRA at Vanguard. You will need at least $3000 to open up the fund I’m about to recommend below, but if you have the $1000 ready, go ahead and open up a Roth IRAwith a Fund I’m going to mention, and you can always transfer to the one I recommend- that’s actually what I did originally when I first opened mine up. The trick is to simply GET STARTED NOW. Make sure you have at least the $1000 set aside in order to begin. Remember, with Roth IRAs, you can always remove this money whenever you like, without taxes or fees! Because Roths are special that way! So, although you should only remove money from your Roth in an extreme emergency, it’s nice to know that your contributions are 100% reversible! Okay, without further ado, here we go:

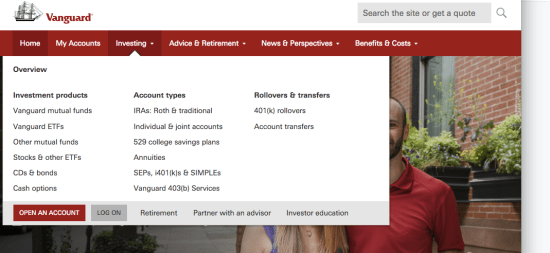

Step 1: Go to https://investor.vanguard.com/home/

Step 2: Click on “Investing” and then click “IRAs: Roth and Traditional.”

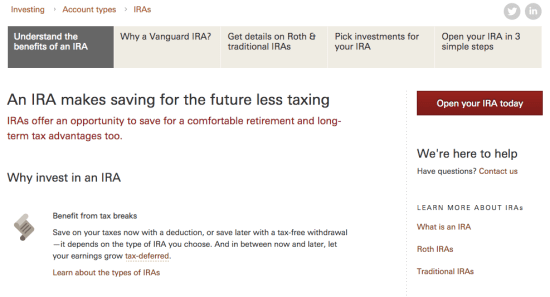

Step 3: On the far right, click “Open your IRA today”

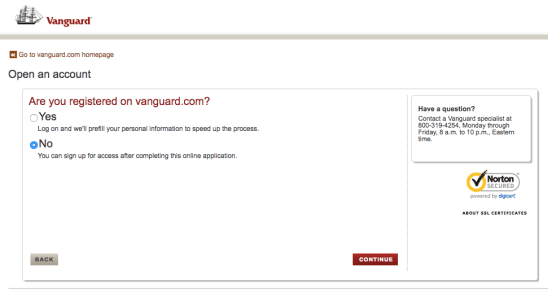

Step 4: Answer the question: “Are you registered on Vanguard.com with ‘no.’ (If you are already registered for another account on Vanguard, of course say ‘yes’ and follow those steps to create your Roth IRA.)

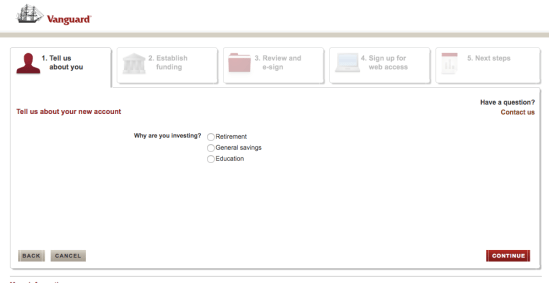

Step 5: Answer the question “Tell us about your new account” by clicking ‘Retirement.’

Step 6: For the next two questions, select ‘Retirement’, and then ‘Roth IRA.’

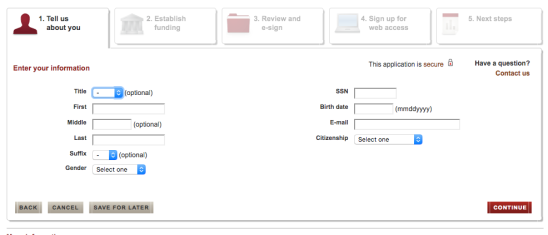

Step 7: Fill in your basic information.

Step 8. From here, you will simply click continue and connect your bank account using your account and routing number, so that you can transfer money easily to your Roth IRA. What’s great about Roths is that any money you put in, you can take out without fees or taxes at any time. This is not the case for regular IRAs or 401ks. Any money you EARN (called interest) from your Roth, you cannot take out without fees until you are 59.5 years old.

Step 9: Once you’ve connected your bank account, continue on to e-sign and set up a username and password for the website.

Step 10: After the basic paperwork is completed, you get to select your funds – aka where you will invest your money. For beginners (or really, for anyone, this is my favorite fund and it’s what I still have) I recommend what’s called a Target Date Account. This is a nicely automated account where you won’t have to play around and rebalance much or at all over the years. The account rebalances itself for you. Basically, you choose how old you’d like to be when you retire and then think of what year it will be when you are that age. So if I want to retire at 65, and it’s 2018 now and I’m currently 34, it will be 31 years until I retire, in the year 2049. So I would choose Target Date Fund 2049.

If you don’t know exactly what age you’d like to retire, don’t let that deter you. I recommend setting your retirement age for 65, and then you can fiddle with things later. So what year will it be when you’re 65? Pick Target Date [That Year], and move on.

For a Target Date Fund, as I said above, you will need at least $3000 to open an account. If you have $1000 and want to get started, I recommend selecting a Vanguard Star Fund and then transferring everything to a Target Date Fund when you have the $3000 (this is actually what I did). There are many reasons why I like Target Date Funds better than the Star Fund, especially for people in their 30s or younger, but it’s a different topic, so I’ll explain it in another post.

Here’s info on Target Date Funds, from Vanguard itself: https://investor.vanguard.com/mutual-funds/target-retirement/#/

Here’s info on the Vanguard Star Fund: https://investor.vanguard.com/mutual-funds/profile/VGSTX

There you go! You did it! You’ve opened up a Roth IRA! If you have questions, feel free to contact us at omgim30@gmail.com, or call Vanguard themselves at 877-311-0016. They’re great to talk to and will help you set things up if you’re confused. Hope this helps!