It’s amazing how habits take shape and slowly, incrementally change the structure of our lives. I feel like it’s usually not the big, sweeping ‘grand decisions’ made in bold statements that change our lives (ie most New Years Resolutions, most “I’ll never drink again!” statements, most “no more sugar for life” proclamations, etc), but actually the small changes made in private moments and repeated again and again that actually make a major long term impact.

In the past year, I’ve made a few changes- most of them arbitrarily or unpremeditated. But these particular changes have slowly but surely changed my everyday patterns of thinking and feeling. Here’s a list of the ones the made the biggest impact.

1. Deleting the Facebook app from my phone- I did this in a moment of pain and anguish on election night back in November. I mean, you get it. But I never put the app back, and that in turn has me going on Facebook a whole lot less. Which in turn frees up a lot of my time. Which also in turn really tones down a bad habit I have of comparing myself to others. I still go onto Facebook and read stuff and post things, but the amount of time I spend on the site has decreased immeasurably. Results of deleting Facebook app on my phone: I feel happier and have more time. And I still have Facebook so I don’t even feel any weird “I deleted my profile feel sorry for me” stress or Fear Of Missing Out.

2. Starting to make green smoothies full of vegetables – I’ve made green smoothies on and off for a few years now, but it’s only recently that I followed nutritionist Kimberly Snyder’s basic recipe for her diet staple: the Glowing Green Smoothie. This smoothie is made up of all vegetables with the inclusion of an apple, almond milk or water, and some stevia. She includes a bit more fruit but I’d rather eat that fruit separately. This smoothie is the equivalent of having something like three or four salads before lunch, without all that annoying chewing. The ingredients of my smoothie, if you want to try it, are a head of romaine, either a bunch of celery or a large cucumber, a handful or two of spinach leaves, a handful of cilantro, an apple, half a lemon, stevia to taste, ice, and a bunch of almond milk or water. Results: I put a TON of nutrients in my body before I have time to think about anything or eat a bunch of nonsense food. Therefore my mind feels clearer and my body feels happy.

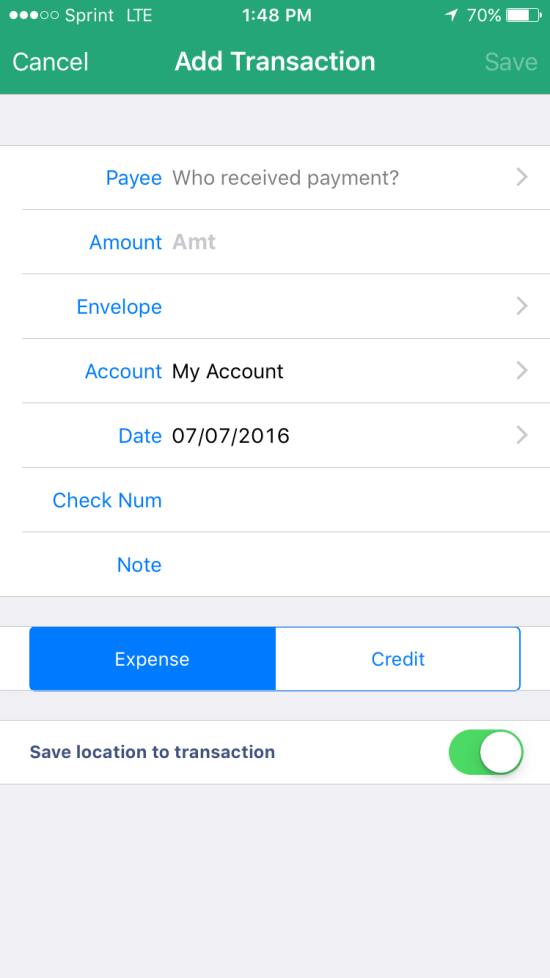

3. Tracking my spending- I wrote about this in the post How Tracking Money is Like Weighing Yourself and then again in The Anti-Budget Budget In Your Thirties. I began using the app Goodbudget to track each and every dollar I’ve spent. I started this back in June, and it was very painful. I didn’t want to track every dollar because I felt like I knew where every dollar went already, and the whole thing felt tedious and filled me with guilt whenever I spent a penny. However, after about a month and a half it all got a lot smoother and easier. I realized exactly where my money was going each month and that small purchases really add up to way more than I thought. I swear I’ve saved a ton of money simply by writing down my expenditures- because I think about where my money’s going every time I spend it. And I feel more accountable for a purchase if I know I have to write it down and it goes into my monthly total.

All of these small activities have added up to big change in my life. Are there any small changes you’d like to start or have recently begun? Don’t worry about those big, scary changes- concentrate on a little tiny change every day, or even every other day. Don’t underestimate what seem like small tweaks- they add up.